KPI Monitoring

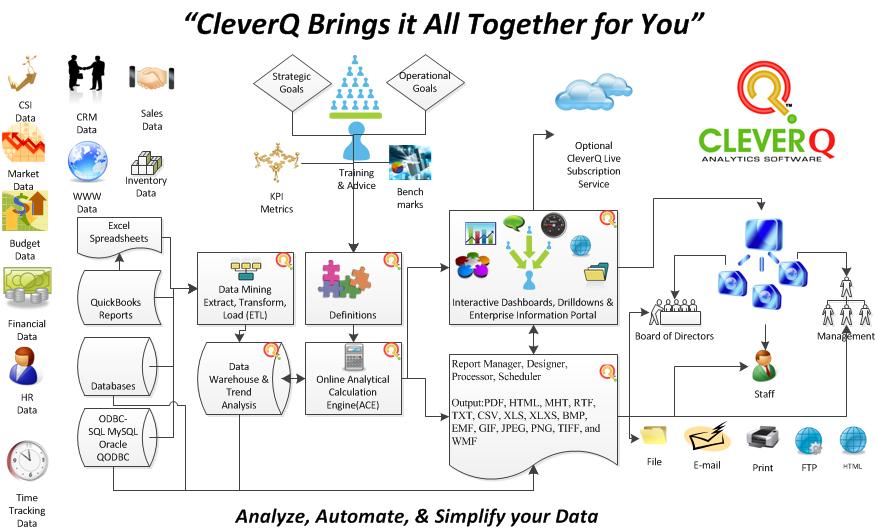

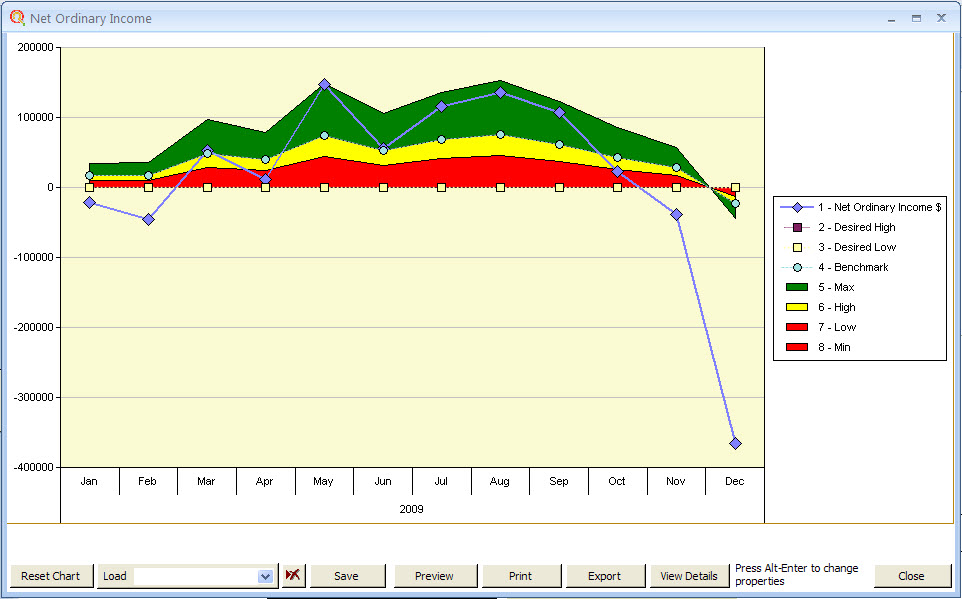

...is pointless unless the right combination Key Performance Indicators (KPI) are grouped and evaluated together. KPI definitions and importance are different for many companies' and/or study groups. A ratio is Key if it is actively measured, monitored and managed and deemed "Key" by management. I have listened to and read many discussions regarding the evaluation of specific KPI measurements, arguing "which KPI is best?" The answer is none. More times than not, the most adamant conversationalists often have become near sighted, and ignored other crucial indicators. Furthermore, since nearly every business is seasonal, traditional KPI formulas used by most, are useless without applying seasonally adjusted annual rates (SAAR), trend analysis, and seasonality forecasting.

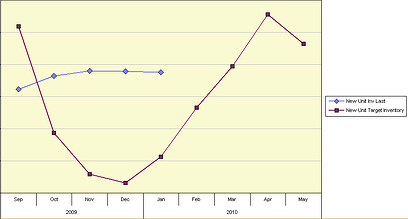

For example; if May is the beginning of the selling season, October is the end, and there is the same inventory on hand in May as in October, do you have the same days inventory on hand? The answer is absolutely not. Do you think improperly calculated KPI by not allowing for seasonal trends could affect turnover, return on assets, target inventory? Unquestionably, yes. Can you accurately predict target inventory levels without knowing your desired turnover, and forecasted COGS based on seasonal trends? Only if you guess!

The Wright Brothers Had Only Three Instrument Gauges: A stop watch, tachometer for engine speed, and an anemometer to measure wind speed. Those indicators were sufficient at the time, but the Silver Dart did not fly very far compared to the space shuttle of today. By today's standards, inventory based KPI, such as gross sales, gross profit and current inventory will get you about as far as the Wright brothers' first flight. Without data visualization technology, could you imagine astronauts flying the space shuttle... with only the help of reports... reviewing historical data after the end of each flight? Try combining the analogy of "hitting the ground at full speed" with "its water under the bridge". It's called your broke and it's too late!!!

The Wright Brothers Had Only Three Instrument Gauges: A stop watch, tachometer for engine speed, and an anemometer to measure wind speed. Those indicators were sufficient at the time, but the Silver Dart did not fly very far compared to the space shuttle of today. By today's standards, inventory based KPI, such as gross sales, gross profit and current inventory will get you about as far as the Wright brothers' first flight. Without data visualization technology, could you imagine astronauts flying the space shuttle... with only the help of reports... reviewing historical data after the end of each flight? Try combining the analogy of "hitting the ground at full speed" with "its water under the bridge". It's called your broke and it's too late!!!

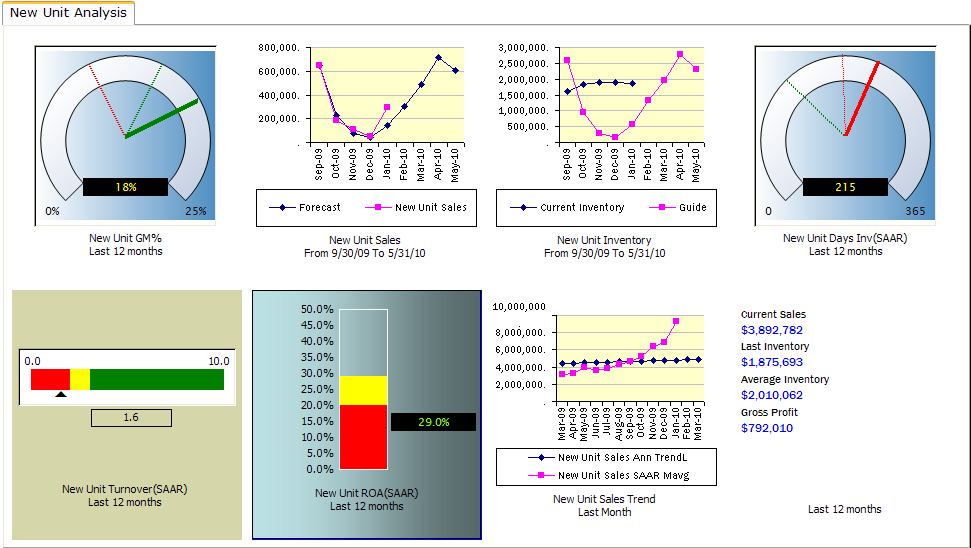

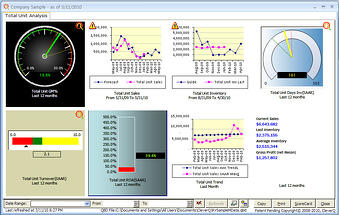

In today's business climate, understanding the complexity and relativity of KPI is crucial to long term success. In time, ignorance will land most businesses out of business. Predictive analysis and seasonality forecasting with KPI measurements of inventory/products based business, should be performed on every product and brand to optimize product mix. Product analysis requires a combination of sales analysis and Inventory analysis. Below are samples... but not all of Product Analysis metrics.

Product Analysis (By Manufacturer, Brand & Body type)

*Gross Margin %

*Gross Margin %- Gross Profit $

- Sales seasonal trend

- Gross Sales

- *Sales (SAAR)

- COGS

- COGS seasonal trend

- COGS Forecast

- Forecasted COGS

- *Target Inventory

- Current Inventory

- *Last Inventory

- Average Inventory

- *Days Inventory (SAAR)

- *Turnover (SAAR)

- Desired Annual turnover

- *Return on Asset

- Unit Sales Annualized Linear Trend

- Unit Sales quarterly moving average (SAAR)

- *Warranty Claims % of COGS

- *Warranty Shortages % of Warranty Claims

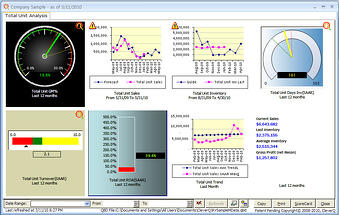

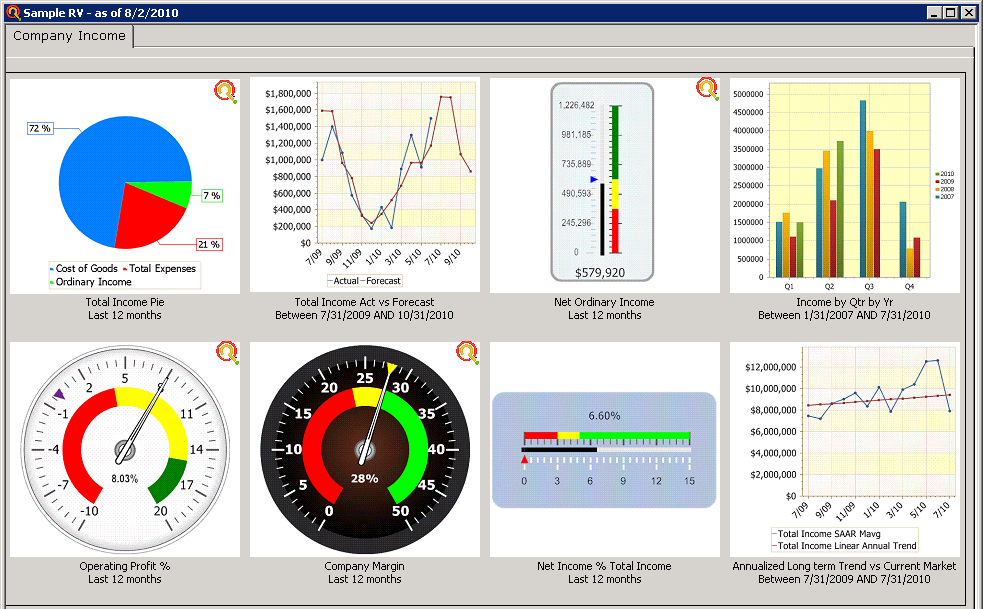

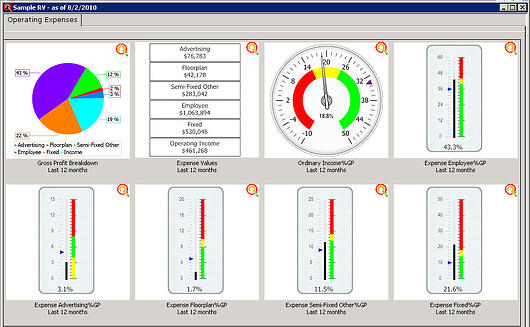

All of the above metrics are important, but not all are necessary to monitor. Some metrics are used only to calculate other KPI which are regularly monitored*. Seeing pages of metrics in a report can be overwhelming for some. Inability to see KPI trends over time on a graph dilutes usefulness. But once the results are properly grouped and displayed visually, analysis becomes much easier to understand. Trends can be identified, and actuals benchmarked against forecasts, trends and budgets. With better understanding of history and trends, better management of inventory and sales decisions in the future can be made.

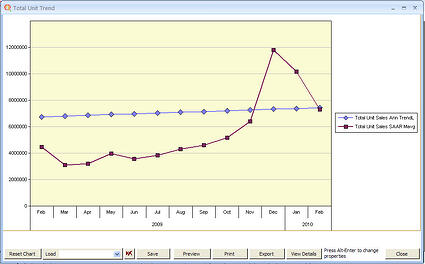

Market trends change quickly. National trends do not always represent company trends. Predictive analytics and seasonality forecasting allows a birds-eye-view to see trends and adjust business practices to changes in a specific market. Most businesses did not see the market change until August of 2008. Solid indicators warned of the change four months prior to the crash for many businesses. Analytic tools would have given most companies time to adjust inventories and overhead in the height of their selling season.

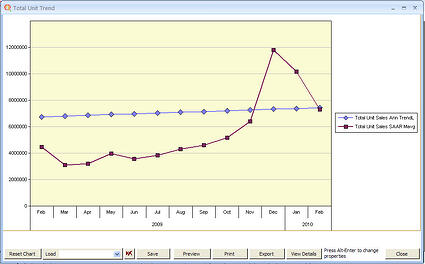

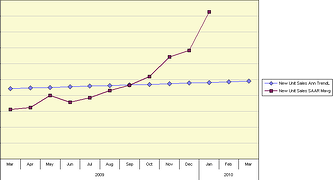

View the sample companies total unit sales market trend. The blue straight line represents the general direction of company sales. The linear sales trend is calculated using 12 months rolling history after removing seasonal trends. The Red trend line represents the Quarterly moving average of actual sales after removing seasonal trends.

View the sample companies total unit sales market trend. The blue straight line represents the general direction of company sales. The linear sales trend is calculated using 12 months rolling history after removing seasonal trends. The Red trend line represents the Quarterly moving average of actual sales after removing seasonal trends.

This graph provides a solid understanding of when the market conditions are changing. Keep in mind that trends can change due to outside conditions which are out of control of the business such as the recession of 2008-2009. Internal factors such as inventory management and sales processes can also change trends.

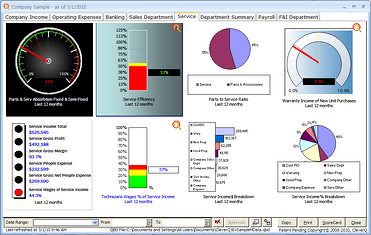

A scorecard for each manufacturer or product line should also be readily available to identify product trends, aid in inventory management as well as assist purchasing negotiations. Manufacturer's representatives respect solid market information and are at most times more willing to help resolve real inventory problems rather than apply unsubstantiated pressure to increase inventory levels.

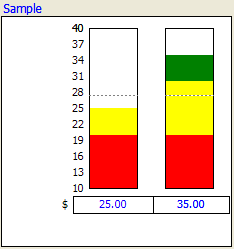

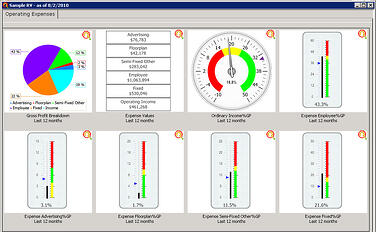

This meter is used to show two indicators. A single range is shown on the left for both bars so both indicators must have the same min and max values. The min and max values are displayed on the bottom and top of the bar. Nine intermediate values are calculated and displayed between the min and max values. A colored bar is drawn to indicate the value of each indicator. A dotted line shows the median value. The bar can take on as many as three colors. Colors are drawn based on the ranges. The actual value is displayed on the bottom of the bar and to the left the units. If the value is out of range, an out of range message will be displayed. A tip icon appears in the top right to indicate some advice is available based on the range the value is in.

This meter is used to show two indicators. A single range is shown on the left for both bars so both indicators must have the same min and max values. The min and max values are displayed on the bottom and top of the bar. Nine intermediate values are calculated and displayed between the min and max values. A colored bar is drawn to indicate the value of each indicator. A dotted line shows the median value. The bar can take on as many as three colors. Colors are drawn based on the ranges. The actual value is displayed on the bottom of the bar and to the left the units. If the value is out of range, an out of range message will be displayed. A tip icon appears in the top right to indicate some advice is available based on the range the value is in. Calculating seasonal trends of the metric

Calculating seasonal trends of the metric

Forecasted seasonally adjusted COGS allows calculations of target seasonal inventory levels based on desired annual turnover. When seasonal trends are removed from sales data, a rolling quarter moving average compared to the linear sales trend visualizes market change directions. When collectively monitored with inverted prime, you can add judgment to the equation, and adjust inventories in advance. The understanding of monitoring metrics holistically allows the birds-eye-view into the future.

Forecasted seasonally adjusted COGS allows calculations of target seasonal inventory levels based on desired annual turnover. When seasonal trends are removed from sales data, a rolling quarter moving average compared to the linear sales trend visualizes market change directions. When collectively monitored with inverted prime, you can add judgment to the equation, and adjust inventories in advance. The understanding of monitoring metrics holistically allows the birds-eye-view into the future. The Wright Brothers Had Only Three Instrument Gauges

The Wright Brothers Had Only Three Instrument Gauges *Gross Margin %

*Gross Margin % View the sample companies total unit sales market trend. The blue straight line represents the general direction of company sales. The linear sales trend is calculated using 12 months rolling history after removing seasonal trends. The Red trend line represents the Quarterly moving average of actual sales after removing seasonal trends.

View the sample companies total unit sales market trend. The blue straight line represents the general direction of company sales. The linear sales trend is calculated using 12 months rolling history after removing seasonal trends. The Red trend line represents the Quarterly moving average of actual sales after removing seasonal trends. ...or Bookkeeper? In day to day experiences with some bookkeepers and support staff comes the objection or resistance to a company successfully installing business intelligence reporting software. Most times, it is for fear of an employee loosing their responsibility of spending countless hours on tasks creating spreadsheets. Fear of a position being eliminated seems to always be lurking under the surface. The key point is that people are needed but rolls change.

...or Bookkeeper? In day to day experiences with some bookkeepers and support staff comes the objection or resistance to a company successfully installing business intelligence reporting software. Most times, it is for fear of an employee loosing their responsibility of spending countless hours on tasks creating spreadsheets. Fear of a position being eliminated seems to always be lurking under the surface. The key point is that people are needed but rolls change. Lack of understanding or confidence is normally an underlying problem. When successful implementation takes place, employees understand the fact that quality analytic tools and data visualization tools do not replace the need of bookkeeping or business intelligence administration.

Lack of understanding or confidence is normally an underlying problem. When successful implementation takes place, employees understand the fact that quality analytic tools and data visualization tools do not replace the need of bookkeeping or business intelligence administration.  Embracing data visualization technology and becoming a part of the solution rather than an obstacle to overcome is the better business decision. New technology is here to stay for business and creates a new opportunity for professional growth.

Embracing data visualization technology and becoming a part of the solution rather than an obstacle to overcome is the better business decision. New technology is here to stay for business and creates a new opportunity for professional growth.

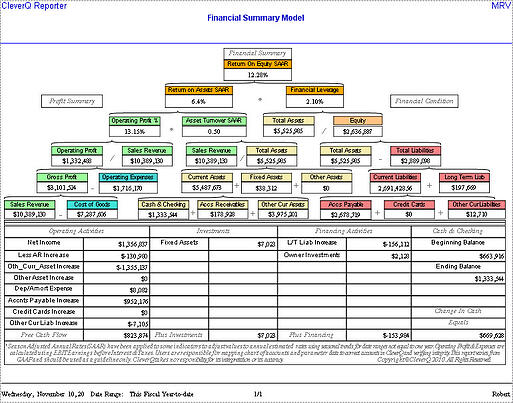

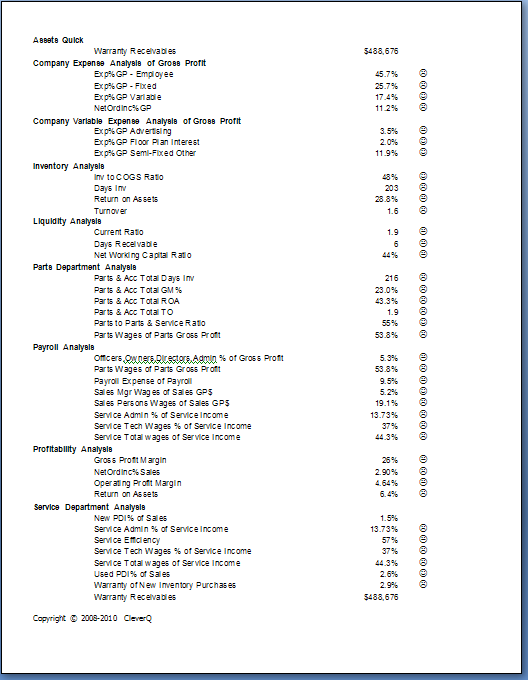

llowing for this methodology. Successful companies, study groups and consultants commonly use this format to measure business performance. Grouping the chart of accounts is also important to compare company performance to Industry aggregate ratios if industry benchmarking is desired. Pay special attention to the following key points.

llowing for this methodology. Successful companies, study groups and consultants commonly use this format to measure business performance. Grouping the chart of accounts is also important to compare company performance to Industry aggregate ratios if industry benchmarking is desired. Pay special attention to the following key points. arly so individuals can manage their success.

arly so individuals can manage their success.